Back on Course

Ways out of the Crisis

The Covid-19 crisis has not affected all parts of the economy equally. For some industries it has even brought more opportunities than challenges. We present crucial considerations for top managers in fields from mechanical engineering to financial services.

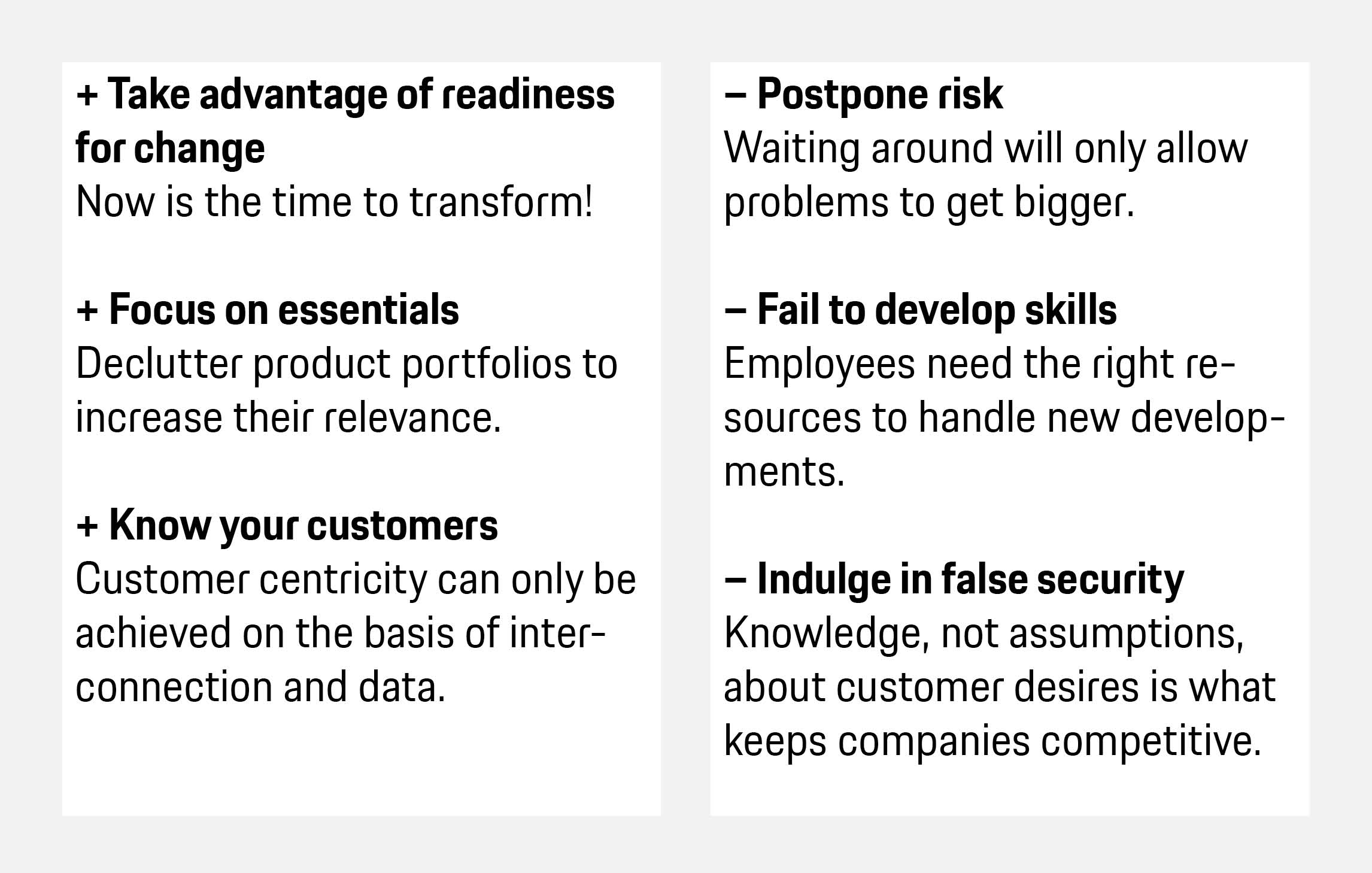

Consumer goods: Know your customers and please them with the right products

Dos & don’ts: Consumer goods companies

White Paper: Creating Growth in Consumer Goods

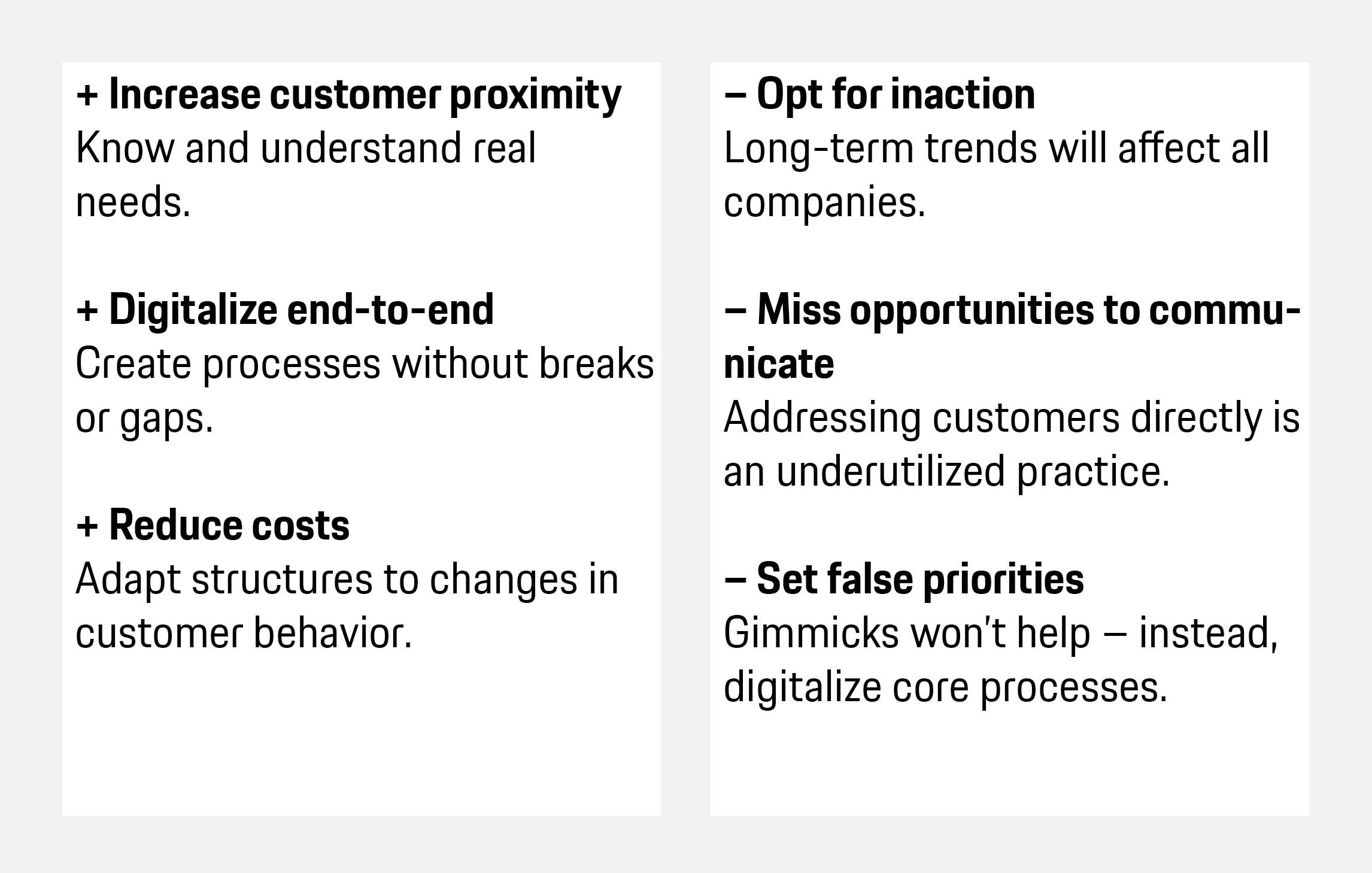

Financial sector: Reduce costs and create digital customer journeys

Dos & don’ts: Banks and financial service providers

Business models for the new normal

Several long-term trends have further intensified as a result of the coronavirus. Now is therefore precisely the time for many companies to critically assess the future viability of their business models. Here are five helpful means of leverage.

Long-term growth via holistic value creation

Integrating the interests of society at large, customers, employees, and shareholders will generate sustainable value.

The United Nations’ Seventeen Sustainable Development Goals can serve as a compass for sustainable growth. They address global challenges such as poverty, inequality, climate change, and environmental destruction, as well as peace and justice.

New business fields beyond traditional industrial lines

Disruptive potential should be sought in targeted ways beyond the current bounds of companies’ fields of activity.

The traditional boundaries between industries are becoming ever more porous. The focus is less on products and services than on customers themselves and holistic solutions for their needs. Established companies that do not adopt this approach are leaving the field open to new players.

Competitive success by focusing on customers and core areas of expertise

Unique customer experiences coupled with tight cost structures and processes lead to better results.

Customer-centric value propositions can only be fulfilled by companies that are set upon achieving high performance. A deep understanding of customers and markets, universally optimized processes, and a focus on core areas of expertise are indispensable factors here.

Digitalization across all company departments

New technologies offer potential for internal processes and business models.

Technological advances are turning companies with brick-and-mortar backgrounds into digital players. That applies to customer experience on the one hand, but also to internal business processes. A digital strategy helps to harmonize these two areas.

Corporate culture as leverage for innovation

The interplay among leadership, organizational design, and innovation-promoting processes is key.

Innovations do not arise by chance, but rather as the result of targeted promotion. Employees should be empowered to develop their potential in this respect. Flat hierarchies and a collaborative culture are helpful.

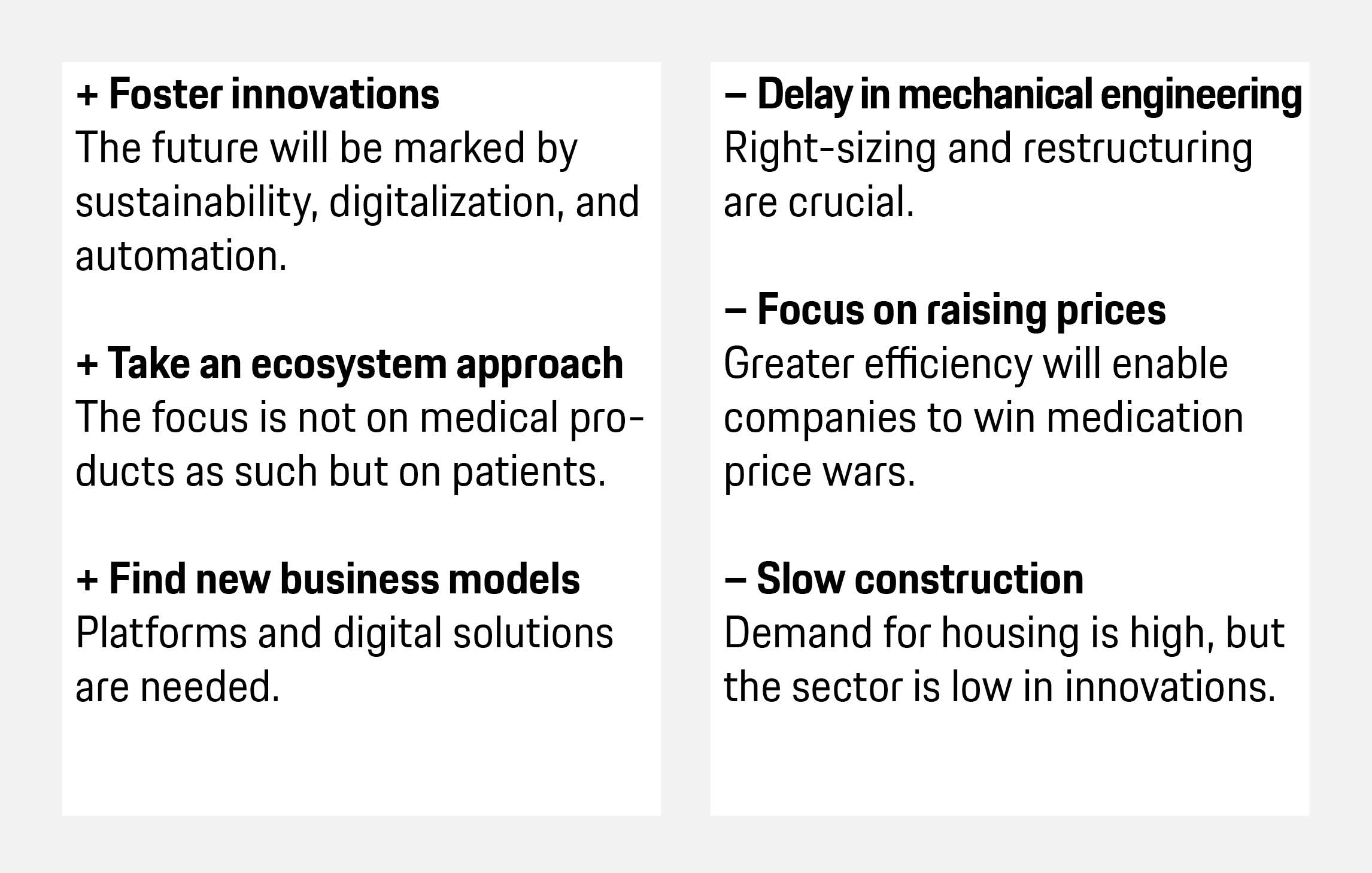

Restructuring in mechanical engineering, new heights in healthcare

Dos & don’ts: From industrial goods to the healthcare sector

White Paper: The Rise of Digital Health